Are you seeing a shift in the PC market?

While notebooks have long dominated, desktops are experiencing a

surprising surge in growth. Based on recent distribution data, this

isn't just a blip; it's a significant trend with clear drivers. Let's

dive into what's fueling this desktop resurgence and what it means for

the broader PC landscape.

For years, the narrative around

personal computing focused on mobility. Laptops became the de facto

choice for many, leading to a period where desktop sales seemed to be

in perpetual decline. However, recent data paints a different picture.

In the first 2 months of Q2, desktop revenue growth has significantly

outpaced notebooks, with a remarkable 22% year-on-year increase

compared to 7% for notebooks. This isn't just about revenue; unit

growth for desktops mirrors this trend, while notebooks only saw a

modest 3% unit growth. So, what's behind this unexpected boom?

A key factor is the looming end of

Windows 10 support. Businesses and individual users alike are facing

an imperative to upgrade their systems. But beyond this, a deeper

issue is at play: the age of the installed desktop base is remarkably

high. Many desktops are long overdue for a refresh, and we're finally

seeing that "bulk refresh" activity kick in. Unlike

notebooks, where refreshes tend to be more staggered, desktops often

see a more concentrated upgrade cycle, especially around significant

OS transitions. This is creating a powerful wave of demand.

The impact of this desktop

resurgence is evident in the overall PC market mix. Desktops are now

contributing a new high to the segment's revenue, nearing 14% in

early Q2, and even higher at nearly 17% when excluding tablets. This

is the highest contribution desktops have seen in the past two

years. While it's important to remember that this growth comes after

many years of decline, and volumes are still lower than pre-pandemic

levels, the current momentum is undeniable.

Geographically, certain countries

are leading the charge in this desktop revival. Germany has seen

particularly strong growth in commercial desktop sales, even facing

some availability issues due to higher-than-expected demand. The UK is

also a strong contributor, with growth across both commercial and

consumer sales. Poland is another key market, driven by growth in SMB

and retailer channels.

Notebooks: Steady Growth, but with Nuances

While desktops are making

headlines, notebooks are also seeing growth, albeit at a more

moderate pace. The same countries driving desktop growth – Germany,

the UK, and Poland – are also contributing to notebook performance.

Interestingly, these are the regions where lower education sales

haven't impacted year-on-year comparisons as severely. In contrast,

countries like France, Spain, and Italy, which saw strong education

projects last year, are now experiencing the ripple effect of those comparisons.

The influence of education sales on

the notebook market is significant. When looking at year-on-year unit

growth for notebooks, which stands at 3% overall, a stark contrast

emerges: education notebooks are down significantly (a whopping 57% in

revenue), while traditional notebooks are seeing healthy double-digit

growth (11% in revenue). This highlights the importance of

distinguishing between these segments when analyzing the notebook market.

The Rise of AI-Capable PCs

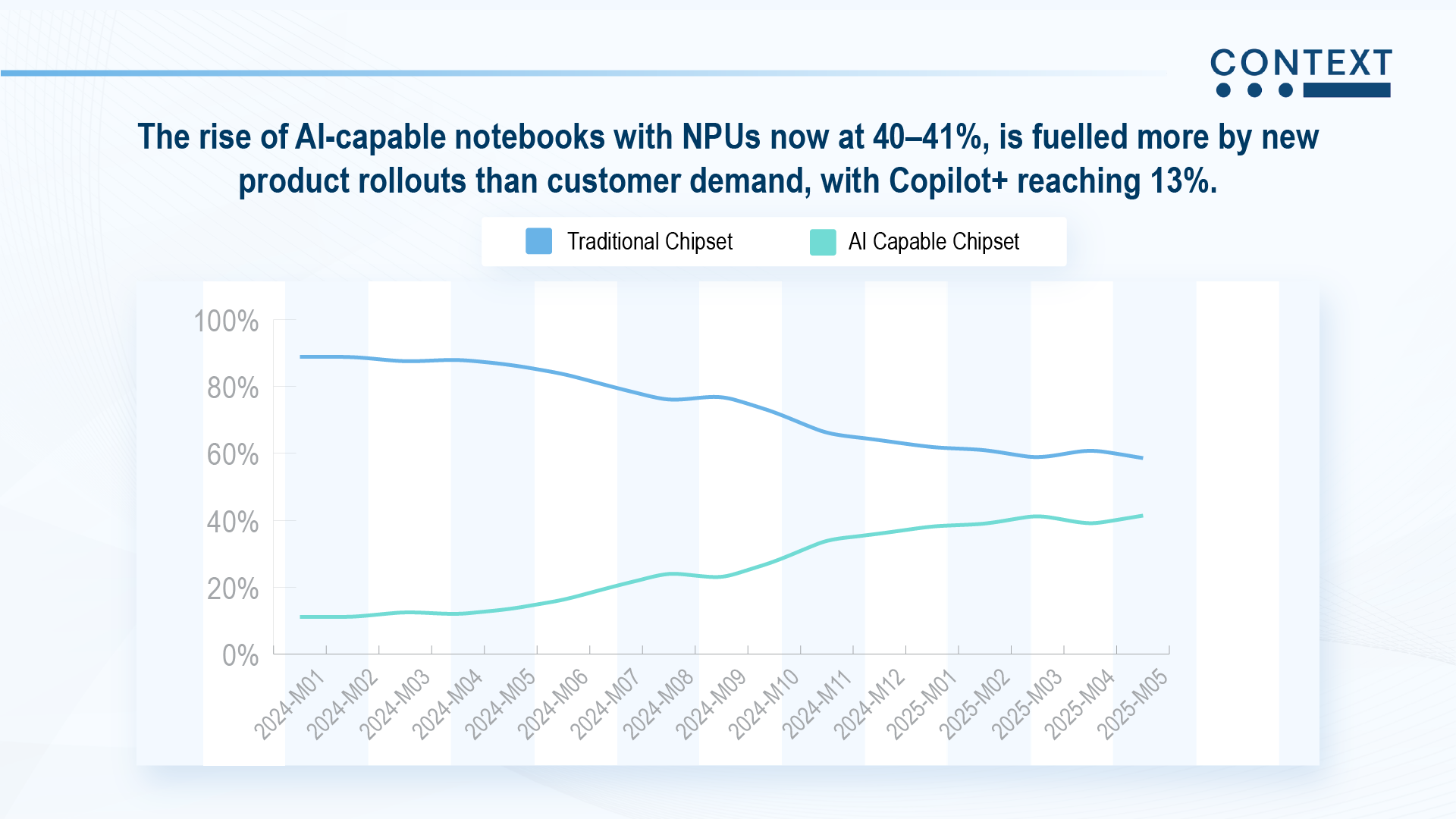

Beyond traditional performance

metrics, the emergence of AI-capable PCs, specifically notebooks

featuring an NPU, is a growing trend. Currently, around 40-41% of

notebooks are AI-capable. While this represents a high share, the

adoption rate isn't primarily driven by active customer demand for AI

features just yet. Instead, it's largely fueled by the rollout of new

products and processor generations. Notably, Copilot+ systems are

gaining traction, making up nearly 13% of AI-capable devices in May, a

significant jump from 5% at the start of 2025. This growth is

predominantly driven by Intel Lunar Lake systems in the commercial segment.

The PC market is dynamic, and the

current desktop resurgence, coupled with nuanced growth in notebooks

and the increasing presence of AI-capable devices, points to an

exciting future. Understanding these trends is crucial for businesses

and consumers alike.

Stay ahead of the

curve—join our IT Industry Forum webinars for exclusive

country-level forecasts and vendor strategy deep dives that

go beyond the numbers.