The European PC landscape is shifting.

While the industry often focuses on the newest silicon, the

combination of economic constraints and the ongoing component squeeze

has brought the refurbished category into sharper focus.

Data from the CONTEXT Weekly IT

Industry Forum shows refurbished unit sales across Europe's 'Big Five'

markets (Italy, UK, Germany, Spain, and France) rose by 7%

year-on-year in Q4 2025. The UK stands out in this dataset, with

volumes effectively doubling over the last 12 months. British

consumers are increasingly treating second-life tech as a primary option.

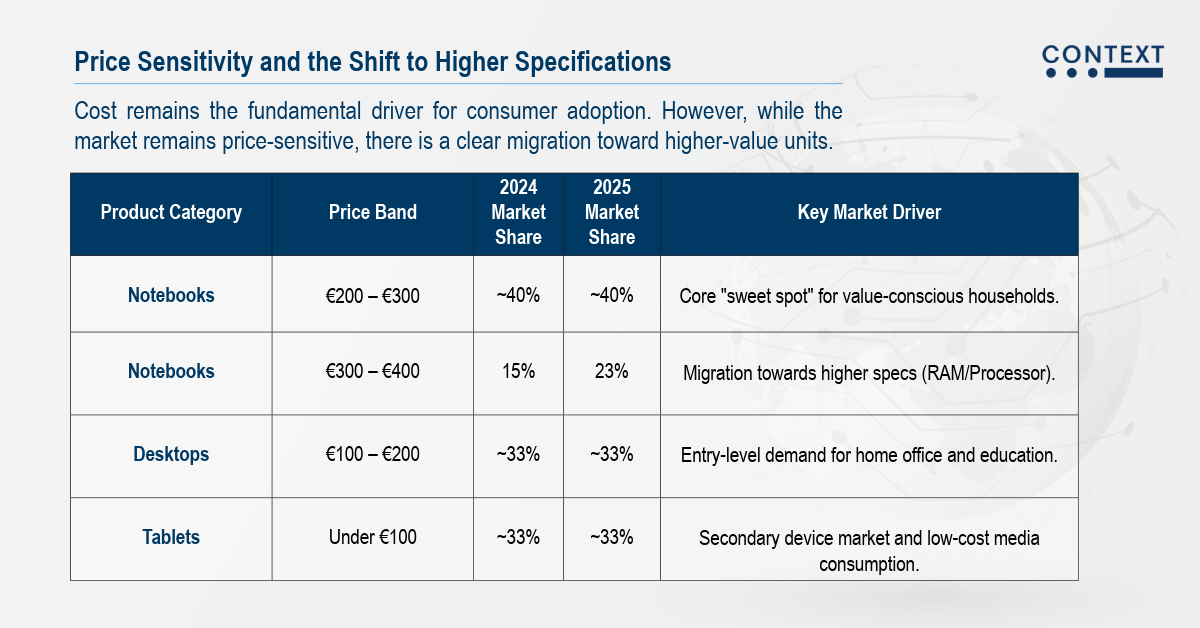

Price Sensitivity and the Shift to Higher Specifications

Cost remains the fundamental

driver for consumer adoption. However, while the market remains

price-sensitive, there is a clear migration toward higher-value units.

-

Notebook Sweet Spot:

The €200–€300 price band remains the most significant,

accounting for approximately 40% of sales.

-

Mid-Range Growth: The €300–€400

segment grew from 15% of the market in 2024 to 23% in 2025.

This suggests that while buyers seek value, they are willing

to increase their spend for improved technical

specifications.

-

Entry-Level Stability: Low-end price points remain vital

for specific form factors. One-third of refurbished tablet sales

fall below €100, while a similar proportion of desktops sell

within the €100–€200 range.

This upward trend suggests buyers

are prioritising performance. They appear willing to invest slightly

more for 'nearly-new' devices to secure better specifications,

rather than accepting the limitations often found in entry-level new hardware.

Managing Inventory Quality in Q1

Supply chain integrity has become

a pressing topic for retailers. High costs for memory and storage

are influencing the specifications of refurbished stock. There is a

noticeable trend of units originally built with 16GB RAM appearing

with 8GB, or sold without memory, to keep prices down.

Ensuring inventory quality is

essential. Retailers vetting their sources now can better avoid

customer disappointment when these machines face 2026 software demands.

The July 2026 Regulatory Outlook

The European 'Right to Repair'

directive arrives in July 2026 and will reshape the circular economy.

This legislation mandates the availability of spare parts and repair

information, lowering barriers to quality refurbishment. Retailers

establishing robust circular models today will be aligned with this

upcoming shift in how technology is maintained and resold.

Retail Pulse Summary

-

UK Growth: The UK has

overtaken Germany in refurbished market share.

-

Performance Demand: Buyers

are moving up-market in search of value without sacrificing

specs.

-

Sourcing

Integrity: Component costs are impacting unit quality,

making strict vetting necessary.

For a regular breakdown of

European retail trends, join the

Retail Pulse Newsletter

now.