London, 10 July 2025 – The global 3D

printer market saw sharply divergent trends in the first quarter of

2025, according to the latest analysis by global market intelligence

firm CONTEXT. Amid looming tariff wars, unstable market conditions,

persistent inflation and high interest rates, the Entry-level class

saw a significant surge in shipments, while the Industrial and

Midrange sectors continued to face headwinds.

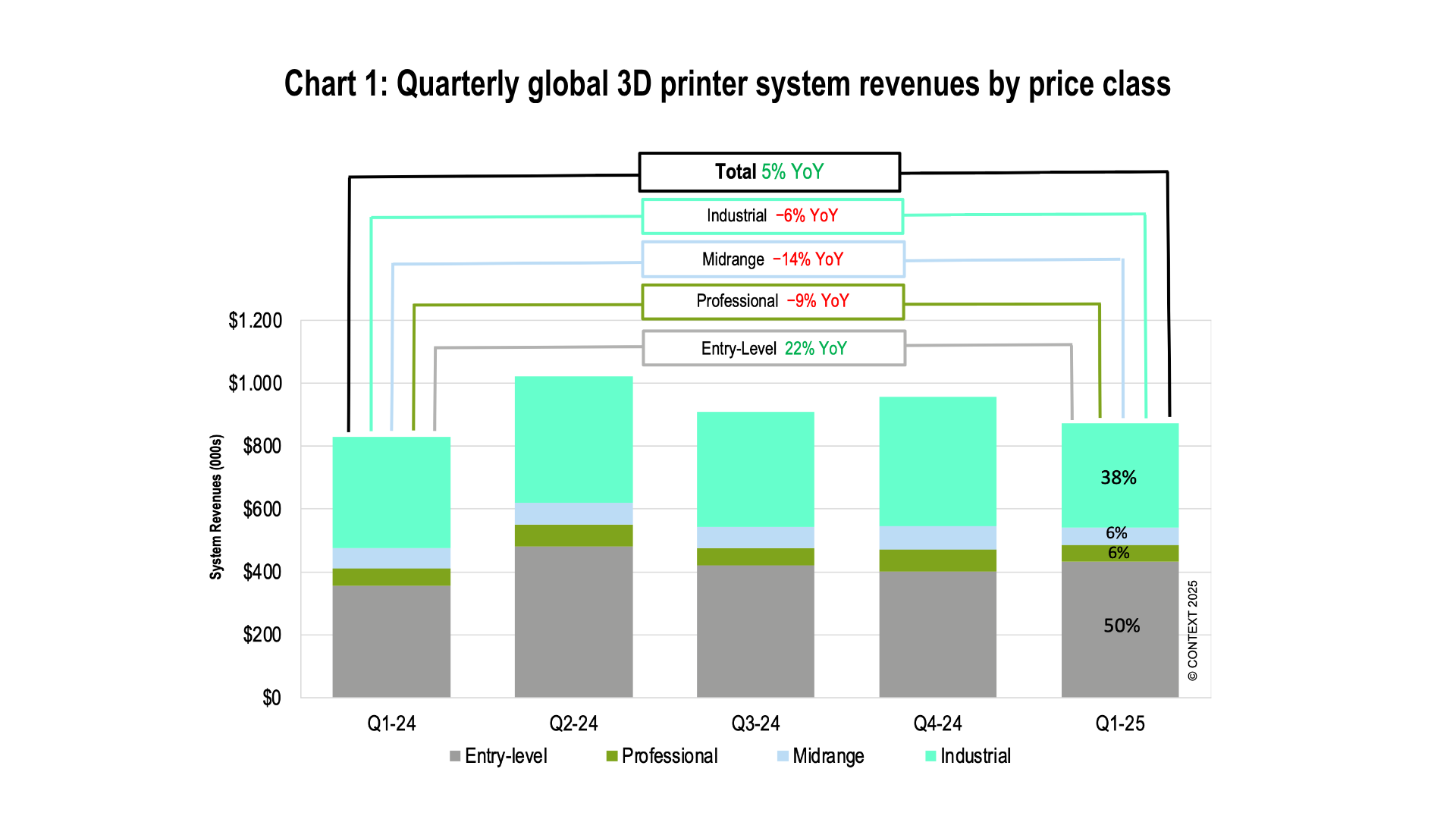

Overall system revenues grew by 5%

year-on-year (YoY), due entirely to a 22% increase in revenues from

Entry-level printers as consumers and channel partners made purchases

to get ahead of threatened tariffs. In contrast, revenues from the

critical high-end Industrial segment slid by −6% as end-markets were

paralysed by rapidly changing tariff policies, unstable business

environments and the high cost of capital.

Three key trends defined Q1 2025:

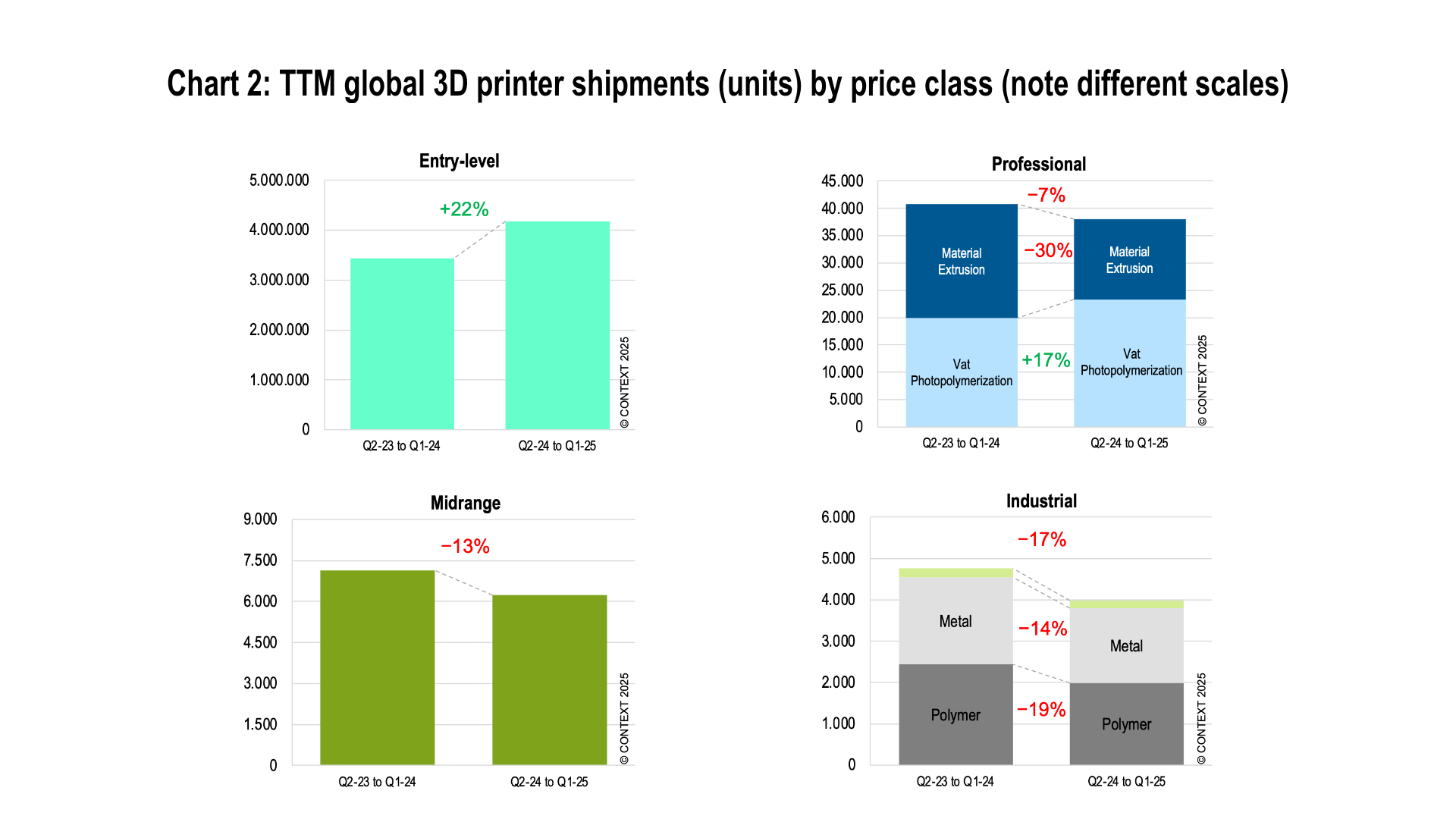

- Entry-level shipments surged, rising 15% YoY, reversing a

negative trend from the second half of 2024.

- Industrial

and Midrange systems continued to struggle as high interest rates

constrained capital spending. Industrial shipments were down −17%

and Midrange shipments −13% on a TTM basis.

- The fortunes

of different technologies within the Professional price class

diverged, and overall shipments saw a modest decline of −4%.

Industrial and Midrange systems

High interest rates continued to

deter capital expenditure, leading to another challenging quarter

for the Industrial and Midrange price classes. Global Industrial 3D

printer shipments fell −14% YoY in Q1 2025. Trends were negative

almost across the board: while Chinese companies held up better than

those in the West, and metals printers did better than polymer

printers, no region or technology was immune to the geopolitical and

inflationary situation. Shipments of polymer systems were down −18%

compared to −8% for metals. Although Industrial revenues experienced

an overall decline of −6% year-over-year in Q1, this decrease was

somewhat mitigated by rising average selling prices for advanced

Metal Powder Bed Fusion (PBF) systems from vendors such as Eplus3D

and Nikon SLM Solutions. Demand for advanced multi-laser, large

build-volume metal PBF systems continued to be a bright spot in the

global additive market, with these two vendors maintaining their leadership.

There was a similar pattern for

Midrange printer shipments, which dropped −16% YoY in Q1 2025. Chinese

vendors – mostly fulfilling domestic demand – fared better than

Western vendors in the period, with Midrange shipments from

UnionTech rising 13%. Demand in China looks to have shifted

down to lower price classes in the period however as UnionTech’s

shipments of their Industrial Polymer machines were down markedly. The

standout vendor in this price class (on a TTM basis) is Flashforge

thanks to strong Asia Pacific and Middle East sales of their material

jetting printer to the jewellery market. Over the

trailing-twelve-month period, established Western companies such as

Stratasys, 3D Systems and Formlabs saw sales fall, contributing to a

−13% drop in global shipments on a TTM basis.

Professional printers

The −4% fall in shipments of

Professional printers masks a significant technology shift. Material

extrusion (mostly FDM/FFF) machines continued to lose momentum, with

shipments dropping −31% in the period (and down −30% over the TTM) as

buyers instead chose high-performance Entry-level solutions from

vendors like Bambu Lab. Conversely, vat photopolymerization shipments

were up 19% YoY in Q1 (and up 17% in the TTM) as vendors such as

Formlabs and SprintRay revitalised the segment by introducing new

products based on mSLA technology and seeing growth as a result.

Indeed, Formlabs’ 40% shipment growth in the quarter keeps them

solidly in the market share lead in this price class.

Entry-level printers

The Entry-level category was the

standout performer in Q1 2025, with over a million units shipped

globally in the period representing a 15% YoY increase. This growth

was almost entirely driven by shipment pull-in as vendors, channel

partners and end-users accelerated purchases in anticipation of US

tariffs on Chinese goods. Chinese vendors accounted for 95% of all

Entry-level printers shipped globally in the quarter. Bambu Lab

performed best in terms of growth, with a 64% YoY increase in

shipments. Meanwhile, although Creality saw a minor sales dip of −3%,

it remained the dominant vendor with a 39% market share based on unit

sales. Other top vendors, including Flashforge and Elegoo, also saw

strong YoY growth.

Outlook

While shipments remained strong for

Entry-level 3D Printers in early 2025, market dynamics in the first

half of the year have led to downward revisions of forecasts for

higher-end systems. Economic headwinds – including tariffs, inflation

and high interest rates – are now expected to persist through 2025,

with a significant market recovery in the high-end of the market not

projected until 2026. While waiting for business conditions to

improve, many OEMs are focusing on profitability, taking time to study

their balance sheets rather than chasing market share, while others

have leaned more heavily on M&A. As newly merged companies

continue to find their feet (consider Nano Dimension after the

acquisition of both Markforged and Desktop Metal), others have

divested or spun-out their additive businesses (consider TRUMPF’s

newly divested metal PBF business), still others have, like Velo3D,

shown continued progress after new investment. Many now offer public

indications of strong growth while fully leaning in to current demand

from regional defence and aerospace markets. Most industrial vendors,

while shifting out or down their 2025 forecasts, still report strong

end-market engagement and interest, fully expecting that it is only a

matter of time before business conditions improve and this demand is

let loose again. Regional onshoring initiatives, the urgent need for

production due to disrupted supply chains (caused by fluctuating

tariffs and geopolitics), and a growing focus on autonomy all present

opportunities for agile additive manufacturing when capital is more

affordable. While the immediate forecast is challenging, there remains

strong underlying pent-up demand, particularly for Industrial systems.

OEMs still report high levels of customer interest, and the industry

is poised to rebound once macroeconomic conditions improve. We expect

a gradual recovery to begin in 2026 as interest rates fall and

stimulate renewed capital spending, similar to the surge seen after

the Covid lockdowns.

* Price classes: Entry-level

<$2,500; Professional $2,500–$20,000; Midrange $20,000–$100,000;

Industrial $100,000+