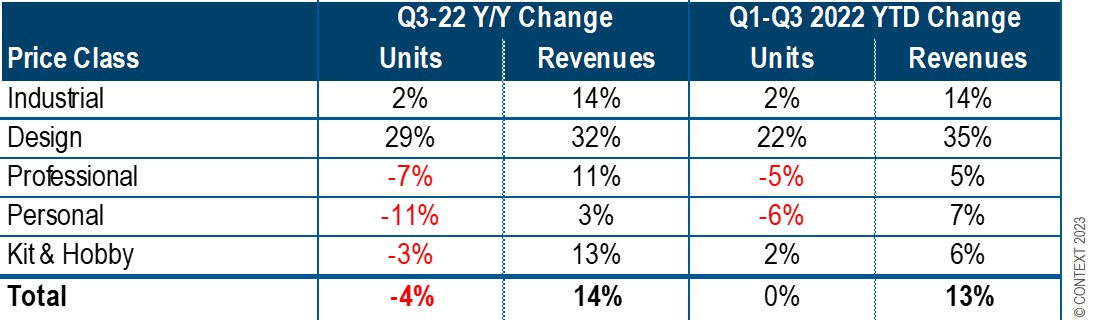

LONDON, 12 January 2023 - Aggregate 3D Printer unit shipments dropped by -4% during the third quarter of 20221, while systems revenues across the same time period rose by +14%, according to CONTEXT, the market intelligence firm.

While great unit shipment disparities were seen across various printer price-classes*, all segments saw system revenues rise from a year ago. Unit volume growth in the period was led by the Design price class with unit volumes up +29% thanks mostly to industry stalwarts launching products in new modalities.

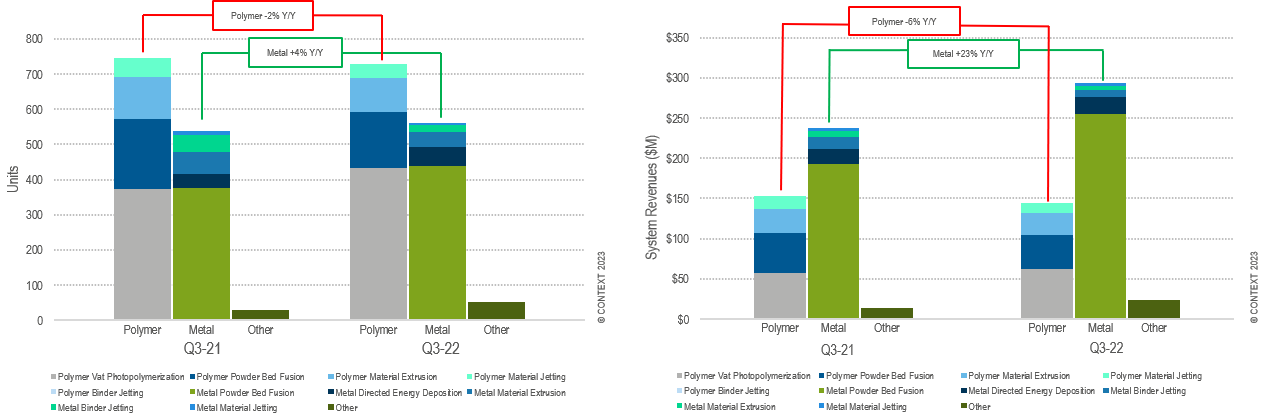

Shipments of Industrial printers were up only +2% with those of Metal printers up +4% and those of Industrial polymer printers down -2%. Professional, Personal and Kit & Hobby shipments were down -7%, -11% and -3% from a year ago due to a combination of both demand and supply issues. Reports of growth in the industry were, thus, more related to revenues than volumes.

Inflationary pressures across the globe led to same-model price increases in all classes helping to prop up revenues. In a separate trend and also pushing up industry revenues, the Industrial metal segment also again benefitted from a shift in demand to more efficient and more productive machines such as for Metal Powder Bed Fusion models with more lasers and greater efficiency that enable higher outputs.

Chart 1: Global 3D printer system shipment changes by price class: Q3-22 and YTD Q1-Q3 22

INDUSTRIAL

Unit shipments in the period were characterised by (1) strong growth for Metal Directed Energy Deposition systems thanks in part to the emergence of new low-end player Meltio, (2) the continued rise in demand for Metal Powder Bed Fusion Systems, especially in China, and (3) rising Vat Photopolymerization shipments thanks to the bounce-back by UnionTech. UnionTech, in fact, drove most of the shipment growth in Q3 2022, bouncing back from their covid lockdowns the prior quarter (when shipments were down -38% Y/Y) to see +62% more printers than in Q3 2021. Over the period, China was not only the largest market (35% of the world's Industrial 3D printers were shipped there) but also saw higher growth (+34%) than either North America or Western Europe.

Many high-profile 3D printer companies made layoffs as industry dynamics shifted from those prevalent at the start of the year. Some faced supply-chain challenges that hindered their ability to ship more units while others are suffering from stagnating demand. Amid fears of a forthcoming recession, some end-markets are, as a precautionary measure, reducing capital expenditure until global macroeconomic conditions stabilise.

Market leader EOS - which has the largest global system revenues in this class - exemplified the trend for revenues to rise much faster than unit shipments, enjoying +35% year-on-year system revenue growth against an increase of only 1% in unit shipments. Other Top 10 companies seeing strong growth in system revenues in Q3 2022 included UnionTech, HBD, SLM Solutions, Velo3D and Desktop Metal.

Chart 2: Global Industrial system shipments by material: Q3-21 and Q3-22

DESIGN

Shipments of Design printer systems were up significantly in Q3 2022, at +29%, increasing growth for the YTD to +22%. This was mostly due to sales of net-new products to the category including Formlabs Fuse 1+30W (already the fourth-bestselling product in this price category), new DLP system from UnionTech, Stratasys' Origin P3, Photocentric's LC Magna and Desktop Metal's Fiber system. New models accounted for 15% of shipments in the category with just two products, Fuse 1+30W and Origin P3, making up 9% of the category total.

PROFESSIONAL

In the Professional price class, shipments dropped -7% from Q3 2021: FDM/FFF printer shipments dropped -8% with SLA printer shipments down-21% from a year ago. FDM shipments were relatively flat over the YTD through Q3, with only -1% fewer products shipping than in the same period of 2021, but the same is not true of SLA shipments which were down -19% from 2021. UltiMaker (the newly combined MakerBot and Ultimaker), which produces both Professional and Personal printers, had a market share of 36% in this price class but in aggregate saw unit shipments drop -14% in the price class. Collectively, UltiMaker and Formlabs (which also saw reduced unit shipments) accounted for 51% of global Professional system revenues in Q3 2022. New to the category this quarter was Nexa3D which is now ramping up shipments of its XiP printers.

PERSONAL AND KIT & HOBBY

Growth in these low-end segments has significantly decelerated since the pandemic boom with both the Personal and the Kit & Hobby segments continuing to be dominated by market share leader Creality. Personal shipments fell -11% in the period. Kit & Hobby shipments were down -3% in the period, were down -10% from Q3 2020 (the pandemic boom) and were generally flat (up +2%) on a trailing twelve month's basis. A significant bright spot is the emergence of Bambu Lab which, in Q3 2022, began shipping against its super-successful Kickstarter campaign that raised $7.1M against 5,513 pre-orders at ~$1,200 apiece. Only two previous crowdsourced 3D printer initiatives have bettered this: Anker ($8.9M) and Snapmaker ($7.8M).

OUTLOOK

Forecasts for 2023 have turned cautious as fears of regional recessions loom large and the worries that the loosening of China's zero-Covid policy may reduce domestic demand and lead to further supply-chain disruption.

However, forecasts for key end-markets (including aerospace) and for key modalities - particularly Metal Powder Bed Fusion - remain strong. BLT and Eplus3D joined SLM Solutions and Velo3D to announce new large-format multi-laser metal systems to help meet this rising demand. Now that HP has fully launched their Metal Jet models and GE Additive is looking to commercialise their Series 3 products, Metal Binder Jetting machines may also help make 3D printing a more mainstream manufacturing process over the year to come.

As was seen in 2022, growth is expected to be much higher in system revenues than in unit shipments with revenues now forecasted to grow +19% across all technologies for the year against a unit volume growth expectation of just +9%.

* Price classes for fully assembled finished goods: Personal <$2,500; Professional $2,500-$20,000; Design $20,000-$100,000; Industrial $100,000+ Kit & Hobby printers require assembly by purchaser

by Danielle Cohen