Every Wednesday our team of CONTEXT

analysts share their expert insight into the IT trends impacting

channel businesses across Europe and further afield. These CONTEXT IT

Industry Forum webinars are the place to access the latest

market intelligence, for better informed strategic decision making.

Among our highlights for May 2025

are positive news for retail chains, the cybersecurity market and Q2

sales through distribution so far.

Network and infrastructure

protection drive cybersecurity growth

The cybersecurity market continues

to thrive on the back of European regulations, the AI arms race,

SMBs looking to outsource capabilities, and a continued surge in

attacks—as illustrated most recently by breaches at UK retailers and

major fashion brands. By the end of April, year-to-date (YTD) annual

revenue growth stood at 23%, rising even higher in Italy (39%) and

Spain (38%). Even the UK turned around negative growth in Q1 to hit

4% year-on-year (YoY) growth YTD. All segments recorded positive YoY

growth, led by network security (32%), infrastructure protection (31%)

and data security (43%). There will hopefully be more positive news to

come, as renewals and new subscriptions come in typically towards the

end of the quarter.

Distribution sales growth

forecast revised up to 4.4%

CONTEXT recently revised up its

forecast for FY 2025—increasing it by just under 1% to 4.4% YoY

revenue growth. The current environment is particularly challenging

given the uncertainty surrounding US tariff announcements. But our

more optimistic predictions are based on strong growth of nearly 5%

YoY that we saw in Q1 2025. We’re expecting Q2 to follow a similar

trend, with virtualization and cybersecurity driving growth, as well

as desktop and notebook refreshes. Telecoms is the only segment we

downgraded after weak demand for smartphones thus far in 2025. Rising

average sales prices (ASPs) are also playing their part in our upward

revision of revenue sales. On a country-by-country basis, the UK is

expected to return to positive growth in H2, after two successive

quarters of decline in 2025, while Spain, Poland, Nordics, and other

countries in Europe are likely to extend strong Q1 growth throughout

the remainder of the year.

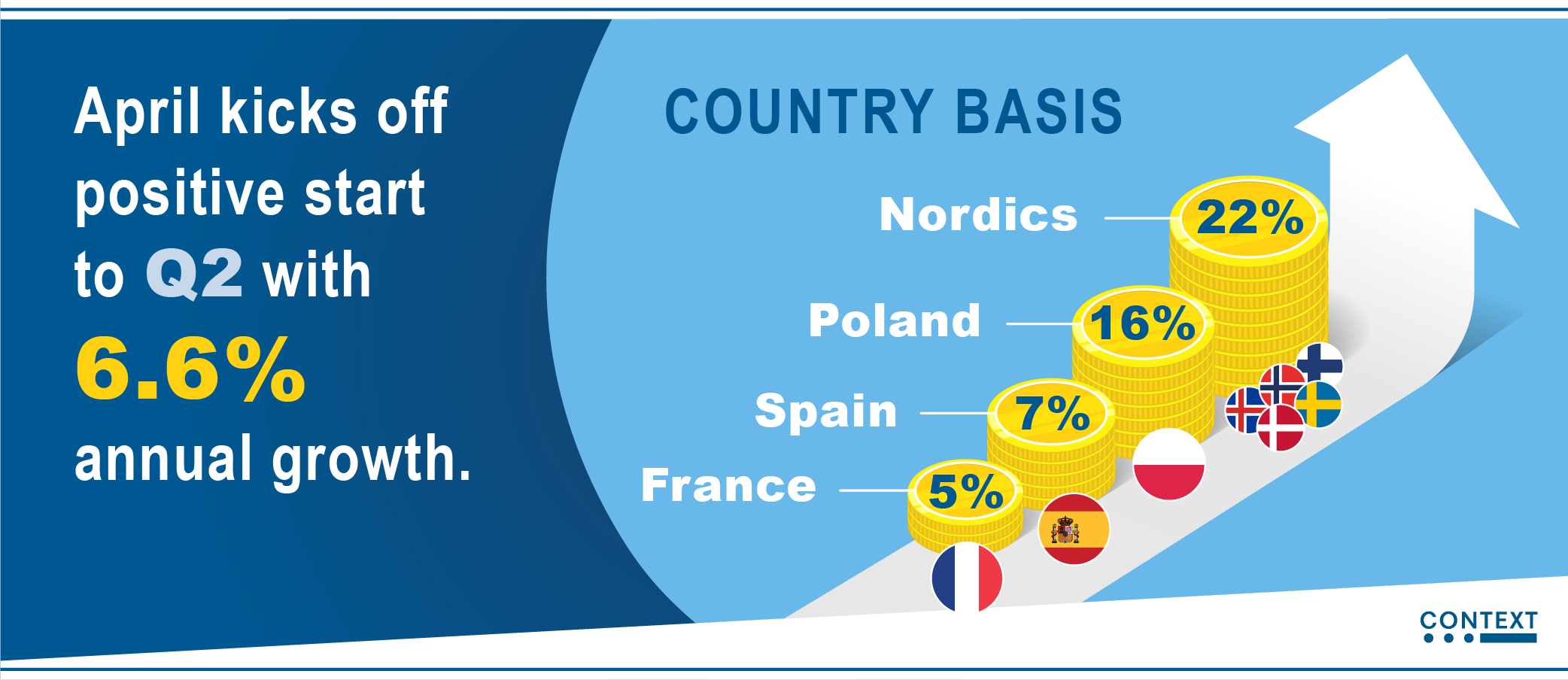

April kicks off positive

start to Q2 with 6.6% annual growth

April got Q2 off to a great start,

with adjusted YoY revenue growth hitting 6.6% for sales through

European distribution. Software and services (21% YoY) was the main

engine of growth for the month, alongside personal systems (10%

YoY)—the former driven by virtualisation sales. When it comes to PCs,

desktops have recorded impressive performance in recent weeks. The

only sector in the red in April was telecoms (-7% YoY), mainly due to

tough comparisons with a year ago when big deals on iPhone 13 and 14

spurred a spike in sales. On a country basis, France (5% YoY) did well

in April after a subdued start to the year, with Spain (7%) continuing

to grow and Poland (16%) and the Nordics (22%) leading the pack—the

latter thanks to impressive server and storage sales.

Sales to UK retail chains

soar in Q1

It’s been a weak Q1 overall for UK

distributors, which recorded a -4% YoY decline in revenue sales.

Particularly disappointing were the figures from March (-6% YoY),

given the end of the quarter is close to the end of the UK financial

year, so one would normally expect excess government and private

sector budgets to be spent then. April seems to have taken some of

that revenue from March, but overall it was still a poor

quarter—especially for SMR resellers (-0.6% YoY) and corporate

resellers (-13%). That’s perhaps not surprising given the continued

high cost of borrowing and lack of business investment. However,

e-tailer businesses are doing much better. They recorded YoY revenue

growth of 12.1% in Q1 2025 and 29.1% in Q2 (up to week 17). Sales to

retail chains were even higher, at 16.4% YoY in Q1 and 29.5% YoY in Q2

(up to week 17).

For more on

these and other IT channel trends, tune into CONTEXT’s

weekly IT Industry Forum webinars. Register here.