The consensus is in: Black Friday Cyber

Monday (BFCM) 2025 is showing promising beginnings, with CONTEXT’s

distribution data up to week 41 indicating numbers are up by over 16%

compared to the same period in 2024. With technology once again

expected to lead consumer spend over the season, a deep dive into our

data reveals critical trends and opportunities for the upcoming sales

surge retailers are anticipating.

The Discerning Consumer: Translating Savings into Investment

Consumers are being exceptionally

careful with their money this season. However, caution should not be

mistaken for insolvency. The national saving ratio is robust, holding

at over 10% in September. What this signals for BFCM is that consumers

are open to high-value investments, provided the rationale is strong

and the bargains are demonstrably genuine. The money is waiting for

the right deal.

A Strong Case for the AI PC Refresh

With Black Friday approaching in

week 48, CONTEXT distribution data up to week 41 shows the clear

beginnings of a potential surge for AI-ready notebook PCs. This

category nearly doubled its share of the market in Q3.

The timing is remarkably good for

high-end PCs. There is a clear, rational need for consumers to dip

into their savings, driven by a key Windows refresh cycle coupled with

the mainstream arrival of AI-capability. Retailers that can

effectively place CoPilot+ PCs in front of shoppers are in a powerful

position to justify the premium and secure the high-value sale.

The Tablet Surprise: Volume Over Value?

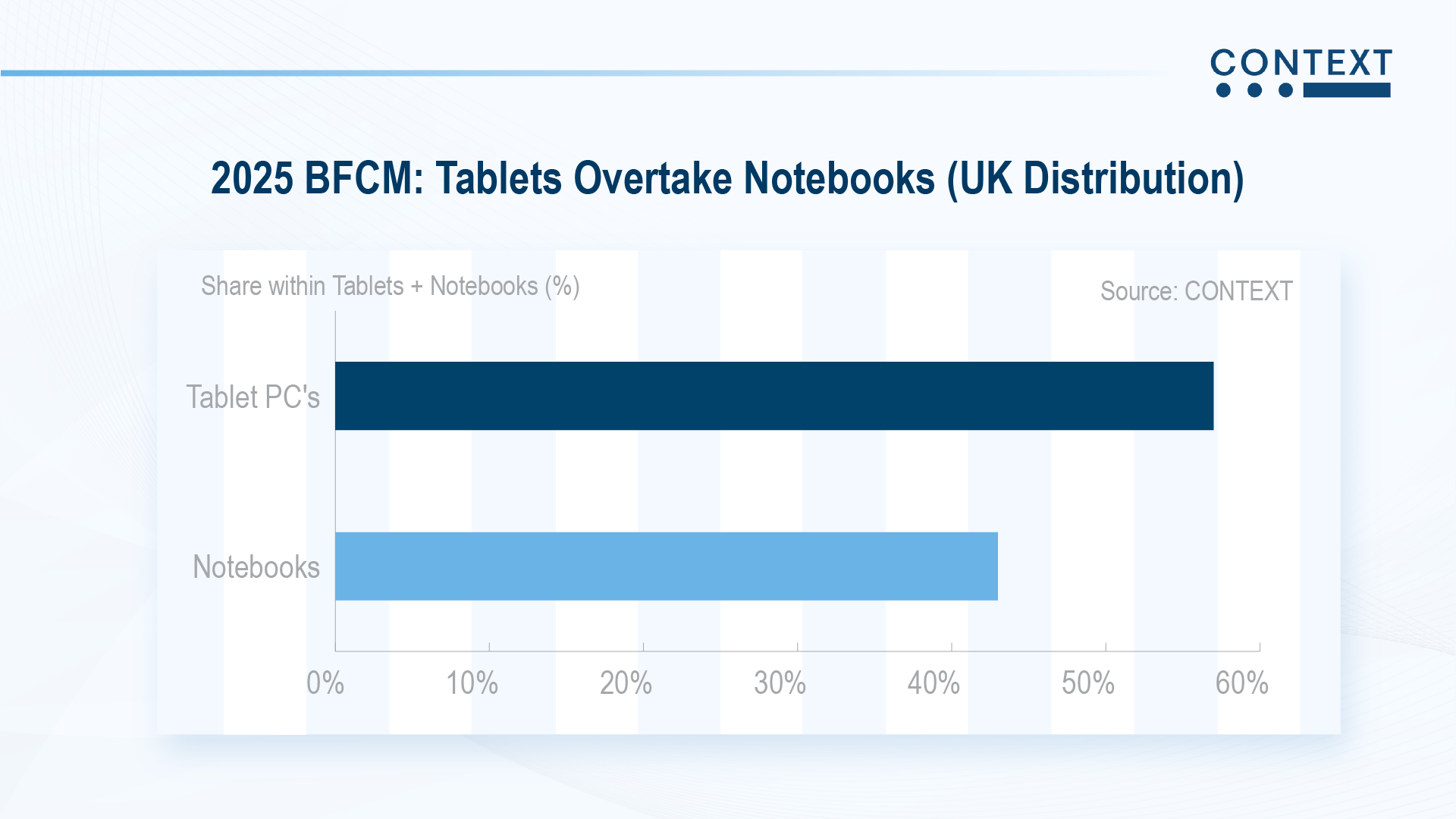

Despite the perfect conditions for

the AI PC surge, we are not yet seeing that growth translate into

distribution numbers. In a key development for the BFCM season,

CONTEXT distribution numbers in the UK currently show Tablet PCs

overtaking notebook PCs in volume.

This shift is characterised by a

small decline in price but a substantial uplift in distribution

volume. This suggests that retailers are placing their inventory

bets here to drive overall traffic and sales.

The Q4 Outlook: Focus on Controllable Success

While none of us possesses a

crystal ball, our distribution data provides the strongest

indication of what retailers are anticipating for the crucial Q4

season. Right now, 2025 looks strong, but success is not guaranteed.

Shoppers are well-informed. The

key variables you can control are 100% credible deals and optimal

inventory availability. These are the critical factors where BFCM will

be won or lost.

Subscribe to

our retail

newsletter for more crucial data and insight.