Welcome to the first edition of Forecast

Fridays, where we highlight the trends and predictions

shaping the IT industry, with insights from the CONTEXT Q1 2024

Forecast Report.

Overall and despite the looming economic and

political challenges, our forecast suggests a 2.3% growth in IT

industry revenues, just below the October 2024 projection of 2.6%.

Anticipating a fourth consecutive quarter of negative growth in Q1

2024, optimism stems from a potential rebound in Q2 2024 as

comparisons against the declines of 2023 come into play.

Positive trends for Personal Systems

The PC market faced significant challenges in

2023, with strong declines in unit sales and revenues. However,

despite a tough Q4, there were pockets of growth. Consumer sales saw

an uptick in some countries, driven by efforts to clear aging stock,

while the education sector boosted the commercial segment,

particularly in Italy and Poland.

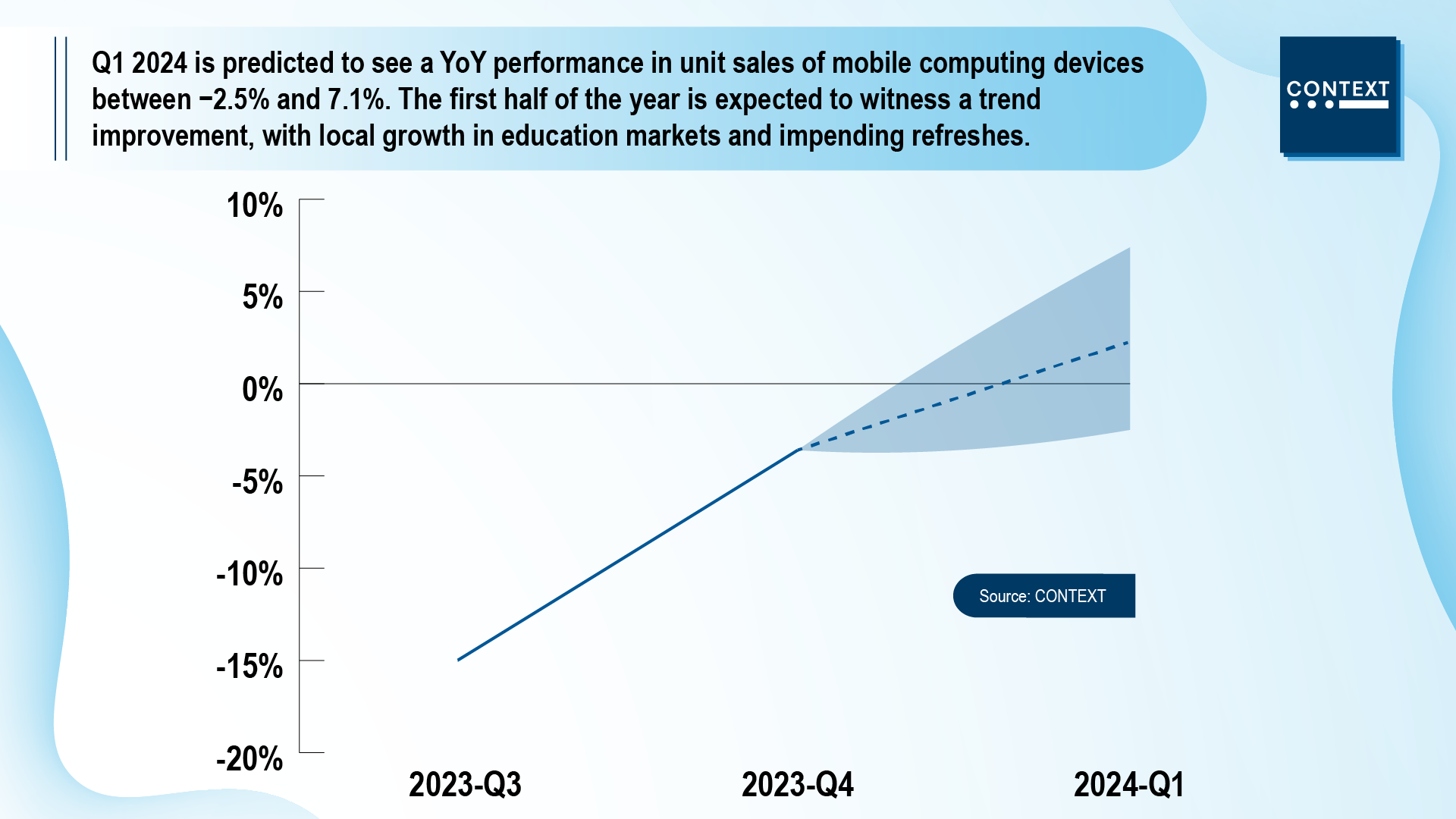

According to our market insights, Q1 2024 is

predicted to see a year–on–year (YoY performance in unit sales of

mobile computing devices between –2.5% and 7.1%. The first half of the

year is expected to witness a trend improvement, with local growth in

education markets and impending refreshes. However, Germany’s economic

struggles may impact overall growth.

The second half of 2024 holds promise, with

expectations of reduced inflation leading to potential interest rate

cuts in the Eurozone and the UK. This could accelerate demand,

addressing previously delayed purchases.

The commercial market is set for new momentum as

companies face the inevitability of refreshes, expiring warranties,

and the transition to Windows 11. The introduction of new

technologies, including AI–based PCs, is expected to make waves toward

the end of the year.

Desktop Computers on the Rebound

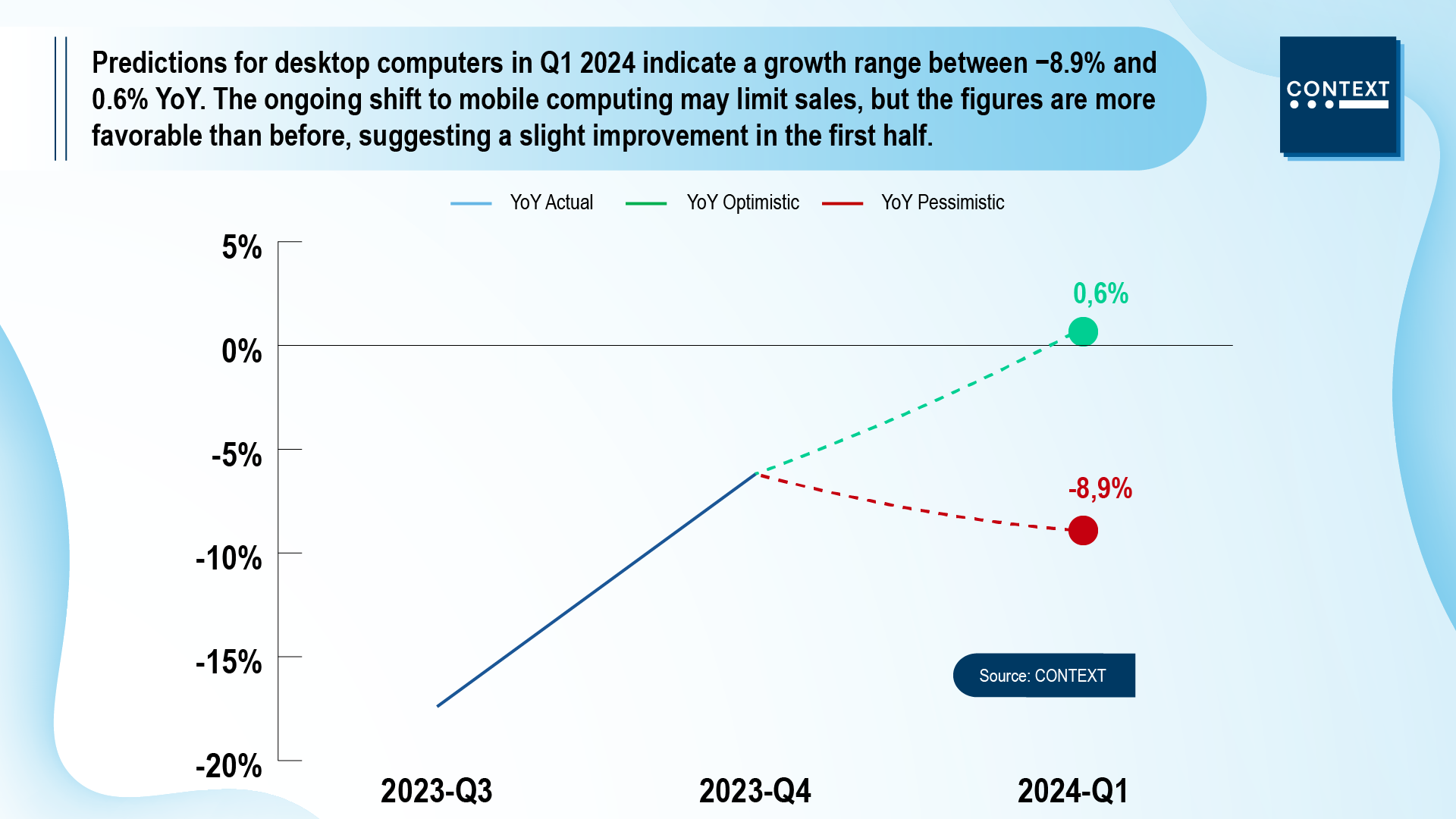

Predictions for desktop computers in Q1 2024

indicate a growth range between –8.9% and 0.6% YoY. The ongoing shift

to mobile computing may limit sales, but the figures are more

favorable than before, suggesting a slight improvement in the first

half. Regional pockets of growth, such as public-sector tenders in

Italy and Spain, are expected.

In light of prevailing economic challenges, the

necessity for PC refresh cycles and the introduction of cutting–edge

technologies are expected to incrementally enhance conditions in 2024.

Stay tuned for more forecast insights next Friday.

To access the full forecast report, please request the

report here .