London, 15 January 2026 – Global

shipments of Industrial 3D printing systems moved back into growth in

the third quarter of 2025, as rising demand from aerospace and defence

and a renewed surge in China’s domestic market helped lift the

high-end of the industry out of a prolonged slowdown. The low-end

Entry-level remained white-hot with rising shipments attracting new

financial investment.

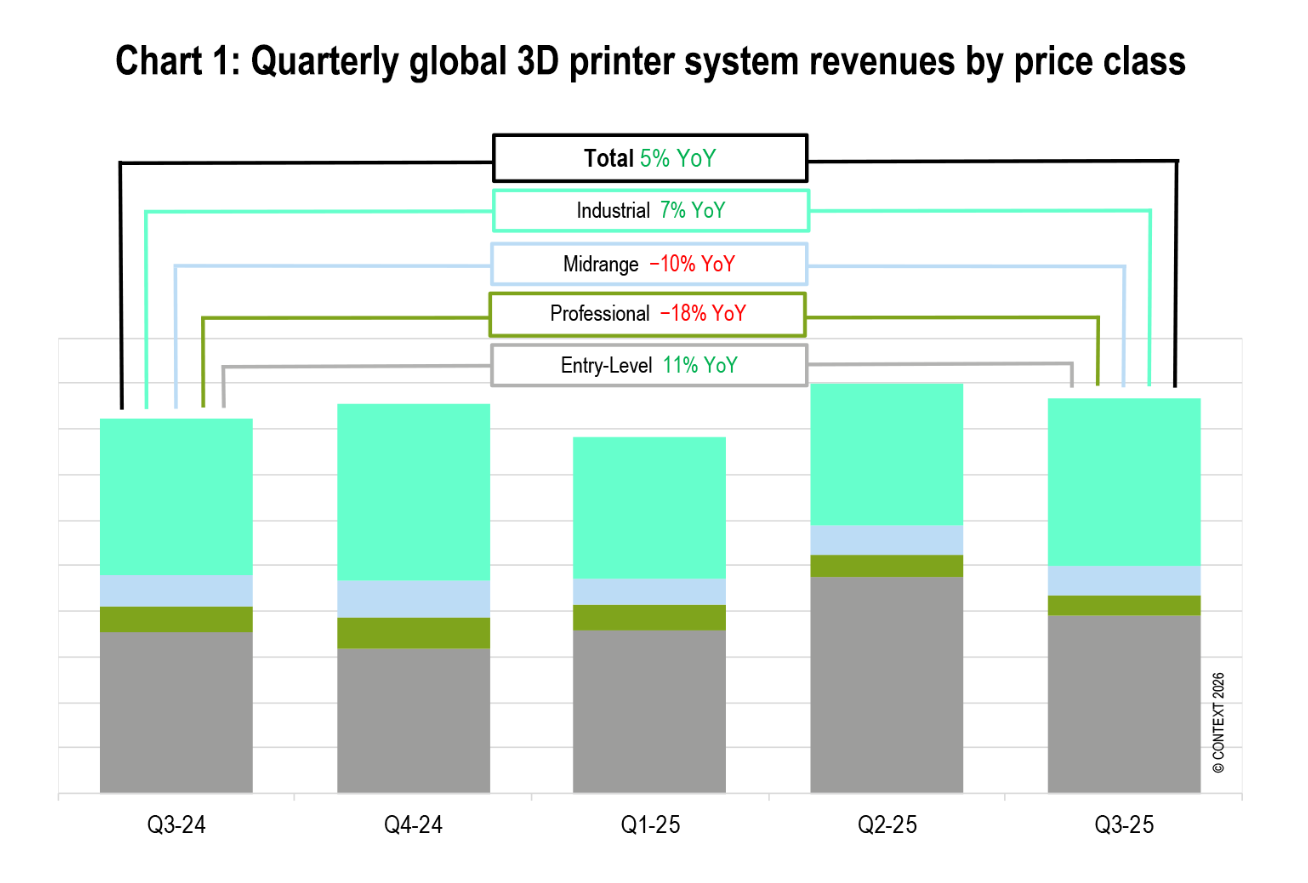

New data from CONTEXT shows total

hardware system revenues rose 5% YoY in Q3 2025, supported by growth

at both ends of the market. Industrial systems benefitted from a

recovery in metal platforms, while the Entry-level continued its

exceptional run.

After two years of weak demand at

the high end, the latest figures suggest conditions are beginning to

stabilise for Industrial machine shipments.

The mood across the high end of the

market is still cautious, but it is no longer defensive. The industry

has moved past the expansion-at-any-cost phase and is now

concentrating on sectors where additive manufacturing is already

delivering clear economic value. Aerospace, defence and domestic

Chinese manufacturing are doing most of the heavy lifting.

Industrial And Midrange Systems: Metal Drives the Recovery

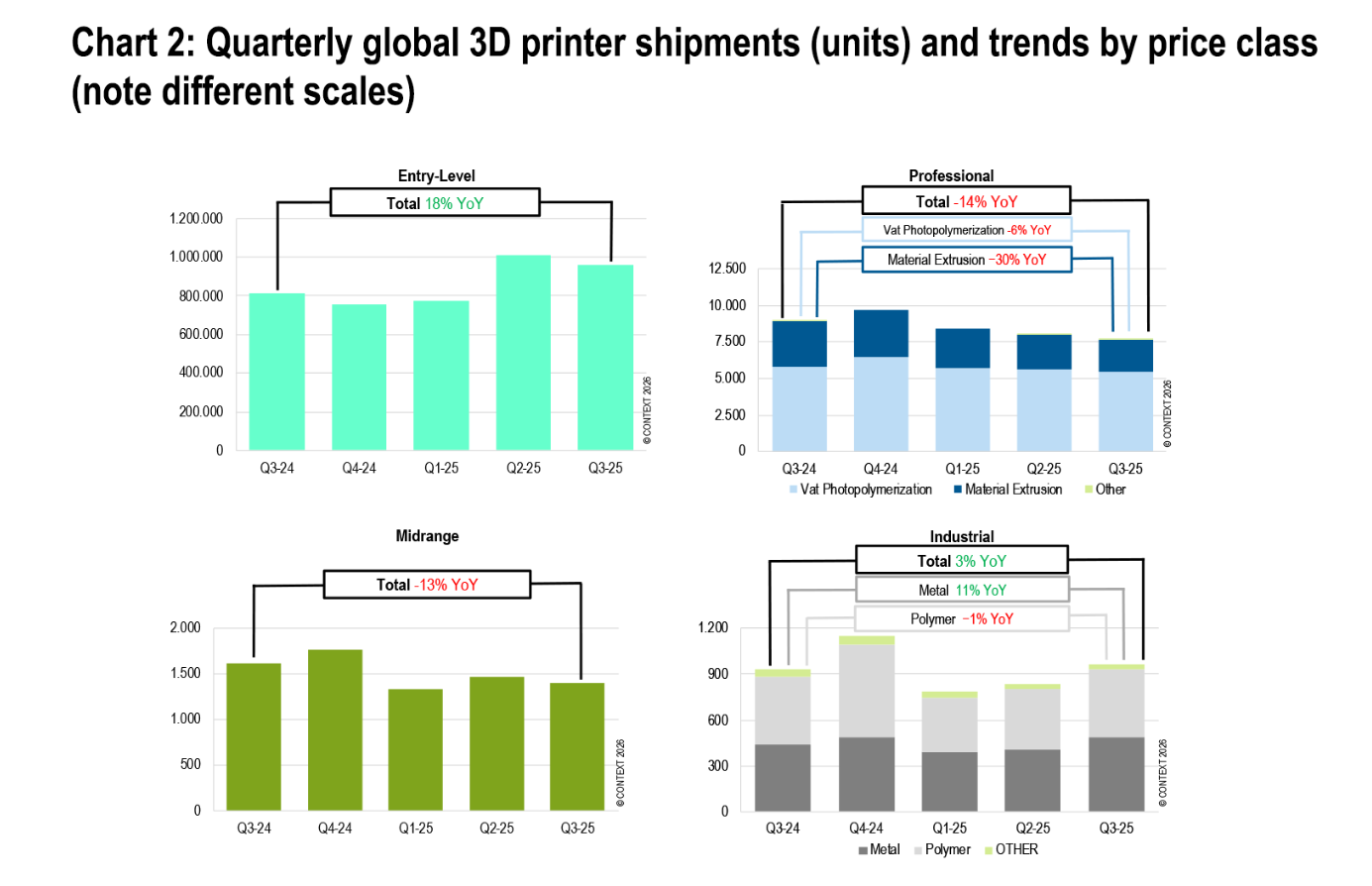

Industrial system shipments,

defined as systems priced above $100,000, rose 3% YoY in unit terms.

Growth was strongest in China, where shipments were up 22%, making

it once again the largest contributor to global industrial volumes.

While industrial polymer platforms

continued to face headwinds, the recovery was instead concentrated in

Metal Powder Bed Fusion systems, where global shipments increased 25%

YoY. Chinese vendors ZRapid Tech and BLT stood out during the quarter

seeing the most significant YoY shipment growth.

China’s domestic aerospace and

private space sectors were the main drivers. Shipments from Chinese

metal PBF vendors rose 35% YoY, with most systems remaining within

the local market. Western aerospace and defence customers also

showed renewed buying activity, although at a more measured pace.

Among Western suppliers, EOS

delivered a strong quarter with revenues up 20% YoY, while Nikon SLM

Solutions maintained its position in large-format metal systems.

China’s Eplus3D also posted revenue growth as demand shifted toward

multi-laser, extra-large platforms. BLT continued its strong run,

recording double-digit year-to-date revenue growth.

The Midrange segment, covering

systems priced between $20,000 and $100,000, remained under

pressure. Shipments fell -13% YoY, reflecting ongoing financing

constraints and the uneven impact of regional on-shoring

initiatives. One notable development was HP’s announcement at

Formnext of its entry into industrial polymer material extrusion

with a new filament platform, signalling fresh competition in a

mature segment.

Across Industrial and Midrange

price classes combined, unit shipment leaders included UnionTech,

Stratasys, ZRapid Tech, Formlabs, 3D Systems, Flashforge, HP, Nano

Dimension (including Markforged), EOS and BLT. Notable positive

year-on-year shipment growth was recorded by UnionTech, ZRapid Tech,

BLT, EOS and HP.

Professional Systems: Technology Migration

The Professional price band,

covering systems priced between $2,500 and $20,000, declined -14%

YoY. The contraction was again driven almost entirely by falling

demand for material extrusion systems. Shipments of FDM/FFF printers

in this price class cratered again as users migrated toward more

capable and significantly lower-priced Entry-level machines.

Vat photopolymerisation systems

remained comparatively resilient. Formlabs retained a dominant

position with around 40% unit-share, supported by recent product

refreshes that helped differentiate its portfolio from lower-cost

resin competitors. Interest also grew around lower-priced continuous

composite fibre systems, with FibreSeek (formerly Anisoprint), raising

more than $4.5 million via Kickstarter.

Entry-Level Systems: Capital Follows Volume

Entry-level systems priced at

$2,500 or below continued to expand rapidly. Global shipments rose

18% YoY, driven by both technical and price-innovation from China.

The segment additionally has become

a focal point for strategic investment. Bambu Lab is widely reported

to be closing a significant funding round, while DJI has made a

strategic investment in Elegoo, marking a notable diversification move

by the drone manufacturer. Snapmaker secured tens of millions of

dollars in Series B funding following a successful crowdfunding

campaign, and Creality has filed an IPO prospectus for a Hong Kong listing.

Market concentration remains high.

Bambu Lab and Creality together accounted for 57% of global

Entry-level shipments during the quarter.

Outlook

CONTEXT expects global additive

manufacturing revenues to grow at a modest, single-digit rate for

full-year 2025, with stronger momentum building into 2026. Recent

interest rate cuts in the United States are expected to ease capital

spending constraints from early next year.

Much of 2025 was spent simplifying

operations and clearing the decks of M&A distractions. Supply

chain resilience, defence investment and regional manufacturing

strategies continue to favour additive manufacturing. China is leading

the recovery today, but improving access to capital should support a

broader rebound across Western markets next year.

Price classes: Entry-level

under $2,500; Professional $2,500 to $20,000; Midrange $20,000

to $100,000; Industrial above $100,000