Quarterly global Industrial 3D printer shipments see diverging trends

Weaker shipments of polymer systems in Covid-hit Shanghai pull down Global Industrial category totals; metal printer shipments continue to rise however thanks in part to surging demand from aerospace

LONDON, 18 OCTOBER 2022 - Just as the Industrial* 3D printing industry seemed to have fully recovered from the pandemic and begun to accelerate, reduced domestic China shipments, directly related to regional Covid flareups, pulled-down global shipments of Industrial 3D printer systems in the second quarter of 2022, according to CONTEXT, the IT market intelligence company. Other lingering Covid-induced issues in the west - including continued supply-chain problems and global inflation - also challenged printer system vendors around the world.

"Inflation across the globe has led to a redistribution of consumer spending", said Chris Connery, Global Head of Analysis at CONTEXT. "This shift is beginning to be felt downstream as vendors selling production equipment for end-markets focused on consumers -- such as those selling machines for clear dental aligners - have seen their orders slow down. Additionally, with fears of a recession looming, cautious CFOs have begun to rethink capital expenditures across many industries and are instead pushing out orders. Some markets however - especially the "space" side of aerospace - have thus-far remained immune and there are both robust shipments of and new orders for mission-critical systems, including metal powder bed fusion (PBF) printers."

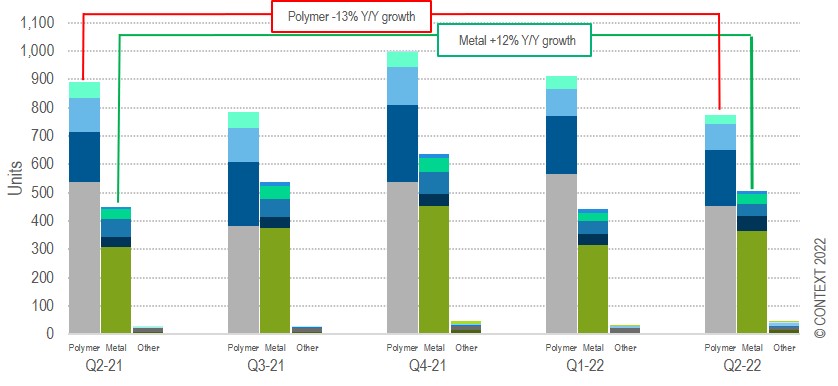

Shipments of new systems in the all-important Industrial price class (which made up 56% of the global system revenues in Q2 2022) were down -3% year-on-year entirely because of a -13% fall in those of polymer systems. A -29% drop in domestic sales into China was directly related to Covid shutdowns in Shanghai. Reduced shipments were also seen in the world's top market, North America - although this change was more related to inflationary pressures. While reduced polymer machine shipments pulled down the entire sector, shipments of new metal machines remained robust with Industrial metal machines shipments rising +12% in the quarter.

Chart 1: Global Industrial 3D printer system shipments (Units) by material and process

In spite of reduced shipments, Industrial system revenues were up +13% year-on-year thanks to inflation-induced price increases and rising demand for more expensive metal systems with larger build sizes and faster throughput (the latter is now often related to the number of lasers in the system). The combination of these factors resulted in a weighted average price increase of +17% that helped many vendors see strong revenue growth in Q2 2022.

Metal powder bed fusion

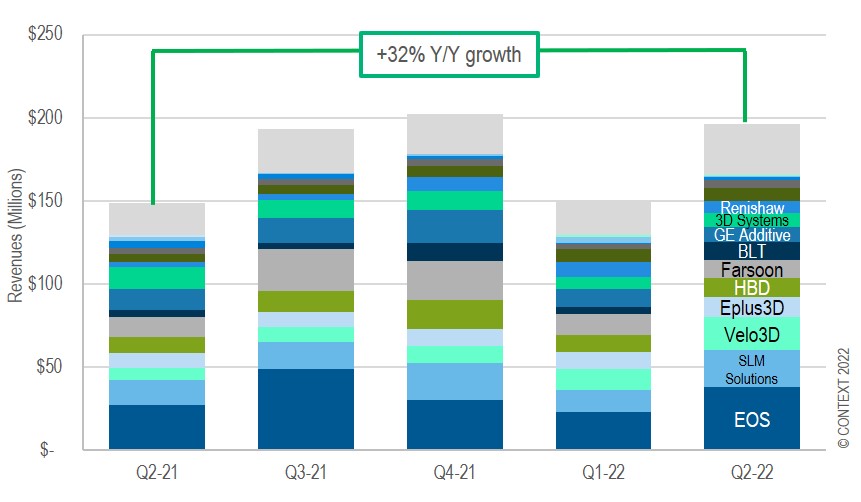

The greatest growth in the Industrial class came from sales of metal PBF printers with aggregate system revenues rising by +32% year on-year. EOS was again the global market leader but other companies, such as SLM Solutions and Velo3D, saw even more impressive organic growth (of +66% and +175%, respectively).

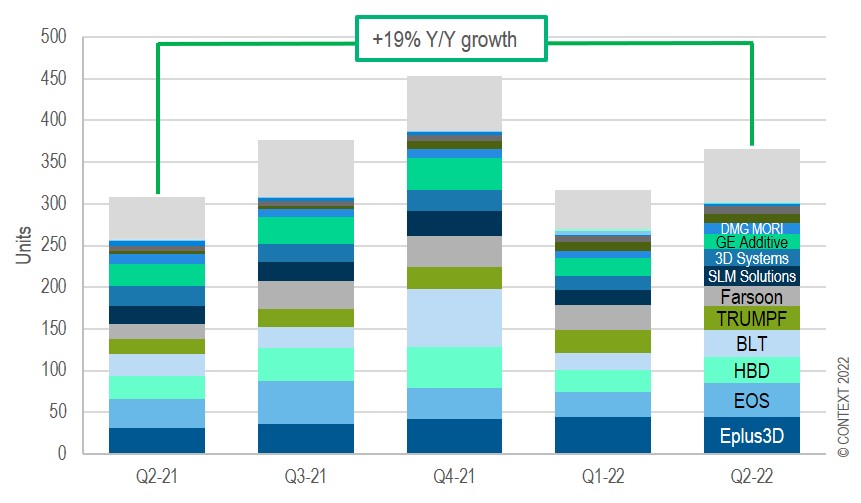

While HP's rollout of their Metal Jet system at Chicago's IMTS led to metal binder jetting technology taking the spotlight, the metals space is still dominated by PBF (such machines accounted for 72% of metal systems sold in the period). Industrial metal PBF printer shipments were up +19% with companies in both the East (BLT, HBD and Farsoon) and West (EOS, TRUMPF and SLM Solutions) experiencing great unit shipment growth. Of the top 10 vendors of these systems, 8 saw more printers ship in Q2 2022 than in Q2 2021. The top vendor in unit shipments, China's Eplus3D, had shipment growth of +45%. With the private space race in full gear across the globe, aerospace continues to be a key market for metal PBF vendors both in the East and in the West.

Chart 2: Global Industrial metal PBF 3D printer system shipments and revenues by vendor

Japan's growing presence

When players in the 3D printing space refer to "Eastern companies" they have heretofore really only been talking about vendors based in China. However, Mimaki and German/Japanese DMG Mori already compete in the additive manufacturing market and Japan's presence is growing. Nikon is set to acquire SLM Solutions - the number 2 company in the number 1 revenue segment (Industrial metal PBF) - and leading electronics manufacturer JEOL has also recently introduced a metal PBF printer. Household name brands based in Japan (Canon, Epson and Ricoh, for example) are also expressing an ever-stronger interest.

Trends in other 3D printer price classes

Design - There was good growth (+15% year-on-year) in shipments of new systems, thanks mostly to market leader Stratasys' recent extension into new polymer technologies exemplified by their strong sales in new vat photopolymer categories. This illustrates the often-seen tendency for the 3D printing industry to grow when trusted, well marketed brands offer products using a different technology and demonstrates that there is no single silver-bullet technology. The growth also suggests that end markets continue to be excited enough about 3D printing to search for ways to use the newest technologies. This bodes well for HP as it extends its offering beyond polymer 3D printing into metal binder jetting.

Professional - Shipments in this price class were down -9% in Q2 2022 and have been relatively flat lately, falling -5% on a trailing-four-quarters basis. Many vendors of Professional machines have begun expanding into the Design class (see, for example, Formlabs new SLS Fuse 1+ 30W solution). Ultimaker and MakerBot have officially joined to form UltiMaker with the hope that the new entity can help accelerate the return to growth of this price class.

Personal and Kit & Hobby - Although shipments of Personal and Kit & Hobby printers were up in the quarter, on a trailing-four-quarters basis, Personal shipments were down -6% and KIT&HOBBY shipments were down -1%. While demand remains higher than it was a few years ago, growth has trended down since the Covid boom of 2020. China's Creality continues to dominate this low-end market.

* Price classes for fully assembled finished goods: PERSONAL <$2,500; PROFESSIONAL $2,500-$20,000; DESIGN $20,000-$100,000; INDUSTRIAL $100,000+ KIT&HOBBY printers require assembly by purchaser.

About CONTEXT

CONTEXT's market intelligence, performance benchmarks and opportunity analysis empower clients to optimise operations and accelerate tomorrow's revenues. With over 35 years of industry partnership and experience reporting on large datasets, CONTEXT delivers analytics at all points in the value chain, providing clients with actionable insights rooted in concrete data and a profound understanding of customer needs. CONTEXT is headquartered in London, with over 300 staff across the world and in 2019 was recognised as one of the UK's Best WorkplacesTM by Great Place to Work®.

Press Contact

Funda Cizgenakad

T: +44 7876 616 246

E: Funda@contextworld.com