Mixed Results for Quarterly Global 3D Printer Shipments as Industry Attentions drawn to M&A

Inflation and increasing demand for high-end systems prop-up Industrial 3D printer revenues but unit sales fall across the globe.

LONDON, 19th JULY 2023 - In a quarter which saw companies jockeying to combine to create the world's first $1B+ 3D printing company, growth in product shipments varied across sectors as economies all over the world grappled with inflation and readied themselves for potential recessions. While unit shipment growth varied, system revenues were up nicely across the board thanks to inflationary price increases and the continuing shift in demand to higher-end metal systems. This is according to insights just released by global market intelligence firm CONTEXT.

"Three of the world's largest 3D printing companies - Stratasys, 3D Systems and Desktop Metal - were in the news in Q2 2023 with the competition between various companies to merge with or be acquired by Stratasys at the centre of it all", said Chris Connery, CONTEXT's head of global analysis. "As the third quarter began, Stratasys was set to merge with Desktop Metal but continued offers from 3D Systems, and from nascent player Nano Dimension, leave the industry guessing."

Global shipments of new additive manufacturing systems in the Industrial and Professional price classes were down year-on-year (YoY) by -15% and -30% respectively in Q1 2023, while the Midrange, Personal and Kit&Hobby categories all saw shipment rise - up 18%, 34% and 29% YoY respectively. Revenues from system shipments in most price classes increased (the exception being those in the Professional class), leading to overall total system revenue growth of 15% on the previous year.

INDUSTRIAL SYSTEMS

The YoY fall in global shipments of Industrial 3D printers - the largest category accounting for 54% of total system revenues in the period - was mostly due to weaker sales of polymer systems (although sales of polymer material extrusion machines held up). This drop did not follow through to revenues, where an 11% YoY rise was driven by growing demand for higher efficiency metal machines.

While sales of almost all types of Industrial polymer printers fell, the sharpest drop was in the largest segment: vat photopolymerization. Shipments of these machines were down -33% with weakness seen across most geographies. In North America, for example, market leaders such as 3D Systems saw sales to certain dental markets slump as inflation led consumers to shift spending away from inessentials (such as cosmetic dental procedures) in favour of fuel and food. While the market in China is rebounding from a difficult end to 2022, market leader UnionTech saw weak sales of their higher-end vat photopolymer systems in this region as well, with weakness reported across many industrial sectors.

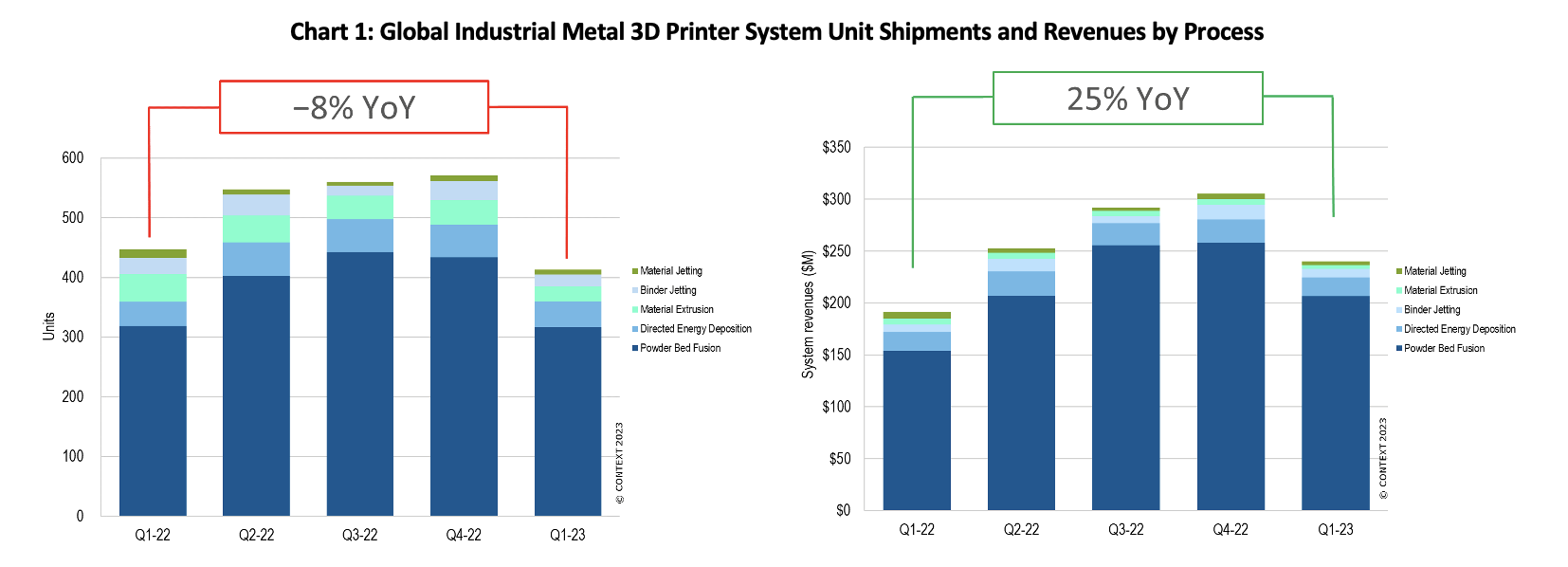

Industrial metal 3D printers fared better: revenues rose 25% YoY in Q1 2023 even though unit sales were down -8%. Powder bed fusion (PBF) printers accounted for 77% of shipments of metal systems but were basically flat (down -1% YoY). Although the number of sales was a challenge, the continued increase in demand for more productive (and larger) systems helped to push revenues for Industrial PBF systems up by +34%. Driving this revenue growth in the period were Velo3D and SLM Solutions (now part of Nikon) with each offering sought-after multi-laser, large build-volume (and higher priced) machines. Vendors seeing strong YoY unit shipment growth included GE Additive, allowing it to join Eplus3D and EOS as metal PBF unit market share leaders for the period.

MIDRANGE SYSTEMS

The 18% YoY growth in unit shipments of Midrange 3D printers - a price class dominated by polymer machines - was driven mostly by: (1) net-new products such as Formlabs polymer PBF Fuse line; and (2) strong domestic demand across multiple end-markets in China for UnionTech's vat photopolymer DLP offerings. Although cheaper polymer PBF machines are, in themselves, nothing new, Formlabs has been able to tap into newly discovered demand, super-accelerating growth: polymer PBF machines accounted for 17% of all shipments in the Midrange category in Q1 2023, compared to just 2% a year ago. Formlabs' success has focussed attention on this category with the period seeing 3D Systems acquire Wematter, and Nexa3D expand their offering by acquiring the XYZprinting product line focussed on the technology.

PROFESSIONAL

Shipments of Professional 3D printers dropped significantly in Q1 2023 (down -30% YoY) although revenues held up a bit better (falling only -15% YoY) as the weighted pricing rose 21% to $7,271. The drop in demand affected all of the Top 5 vendors but UltiMaker (which recently combined with MakerBot) remained the class leader in both unit shipments and system revenues. Foreseeing the stagnation in this category, vendors like Formlabs had initially introduced new products -- like low-end polymer PBF printers -- into this Professional price-class with some success seen in the year-ago quarter. Demand in recent quarters has however moved to a slightly more advanced product, which, when combined with inflationary price increases, has shifted this low-end polymer PBF segment into the Midrange category, a phenomenon which also contributed to the YoY comparison results. This price-class has been dominated however by Material Extrusion and Vat Photopolymerization shipments with Powder Bed Fusion shipments - while accelerating - yet to make much of a dent in overall market share. If shipments of polymer PBF systems are excluded from the figures for Q1 2023, shipments of core products in the category still fell by -28% (with Material Extrusion down -33% and Vat Photopolymer shipments down -18%) so it was a difficult quarter for vendors working in this price class regardless of how sales are measured.

PERSONAL AND KIT&HOBBY

Although there were excellent sales of lower-end, consumer-centric Personal and Kit&Hobby printers in Q1 2023, full-year growth expectations for the category remain subdued as these shipment increases were mostly due to improved supply-chain logistics and other factors than to new demand. For instance, AnkerMake shipped huge numbers of its Personal machines in the period but the demand was generated, and orders placed, during a super-successful Kickstarter campaign in 2022. One strong exception for the period was Bambu Lab where fantastic demand allowed them to successfully move from crowd funding into mainstream commercialisation; in fact, demand for their products was so strong as to help accelerate them to the number two global market share position in the quarter surpassed only by Creality.

OUTLOOK

"While much of the industry's attention has recently been focussed on Western company consolidation, vendors like China's Farsoon have continued the trend in the Asia-Pacific region of going public by way of more traditional IPOs", added Chris Connery, CONTEXT's head of global analysis. "While mergers, acquisitions and public listings often dominate headlines, such actions do not typically drive demand or market growth in the near term. Separate from the potential industry consolidation, the prospects for 3D printing remain bright, with demand growing and accelerating, especially as many companies are managing to keep supply-chain challenges and reshoring initiatives at top-of-mind while the inside-the-industry machinations play out around them."

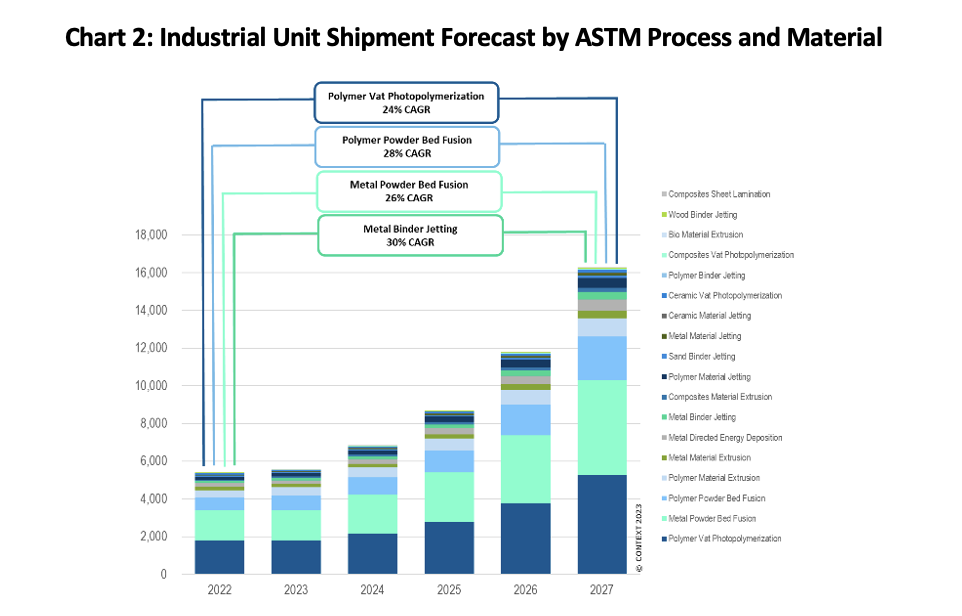

3D printing continues to excel in prototyping, and there is still ample room for growth in the areas of mass customisation and low-volume production of complicated parts according to CONTEXT, but it is volume mass production which has the strongest growth potential in the coming years.

For polymers, technologies such as vat photopolymerization and PBF are best poised to meet these mass production needs; whereas it is PBF and binder jetting technologies that are best positioned to accelerate metal AM into mainstream production. Indeed, metal PBF is the leading technology in the Industrial market and is on track to see a 5-year shipment CAGR of +26%. Meanwhile, although forecasts predict that metal binder jetting will remain behind PBF, the projected CAGR through to 2027 for this technology is +30%.

* Price classes for fully assembled finished goods: Industrial $100,000+; Midrange $20,000-$100,000 (this category was previously known as Design); Professional $2,500-$20,000; Personal <$2,500; Kit&Hobby printers require assembly by purchaser.

About CONTEXT

CONTEXT's market intelligence, performance benchmarks and opportunity analysis empower clients to optimise operations and accelerate tomorrow's revenues. With over 35 years of industry partnership and experience reporting on large datasets, CONTEXT delivers analytics at all points in the value chain, providing clients with actionable insights rooted in concrete data and a profound understanding of customer needs. CONTEXT is headquartered in London, with over 300 staff across the world and in 2019 was recognised as one of the UK's Best WorkplacesTM by Great Place to Work®.

Press Contact

Funda Cizgenakad

T: +44 7876 616 246

E: Funda@contextworld.com